Headline Posts

The Future of Electric Vehicles and EV Chargers

For 60 years, Reliance Home Comfort has provided Canadians with reliable heating, cooling & hot water products...

5 Ways Builders Are Modernizing Homes

If you’re a builder, specifically one who does renovations, you probably noticed that a lot of properties...

3 Key Takeaways From the Restaurant Canada Show 2022

Each year, restaurateurs gather in the heart of downtown Toronto to connect and learn at the Restaurant...

What Features Are Homebuyers Looking For in New Builds in 2022 & Beyond?

The RelianceTM Builder Program is designed to provide builders and contracts managers with equipment solutions for their...

Are Canadian Individuals & Businesses Financially Optimistic in 2022?

In 2021, we have looked at the ways in which Canadian property managers, home builders, commercial business...

How Ductless HVAC Systems Can Offer Solutions for Property Managers

Your residents should always have access to reliable heating and cooling when they need it most. If...

3 Ways We Help Medical Offices Upgrade Their Facilities & Look Out for the Bottom Line

RelianceTM Commercial Solutions helps Canadian medical offices, dental clinics and other facilities avoid downtime, free up capital for more critically needed investments or...

Improving indoor air quality is more important than ever

Add value to your new home HVAC offering with a free germicidal UV light valued at $499*. With most of us still spending...

How Reliance Can Help Kickstart Restaurant Operations After a COVID Shutdown

RelianceTM helps Canadian restaurants and other commercial businesses minimize downtime, provide useful capital, mitigate unplanned expenses and create an optimal customer experience. With...

RINNAI® DELIVERS EASY INSTALLATION, BETTER OPTIONS AND SATISFIED CUSTOMERS

Looking for a boiler that offers uncompromising reliability, a wide range of features and makes way for a fast and...

Sensei™ – Easy Installation, Top Performance And Energy Savings

Thanks in large part to their space saving compact size, their energy efficiency and easy installation, tankless water heaters continue to gain in...

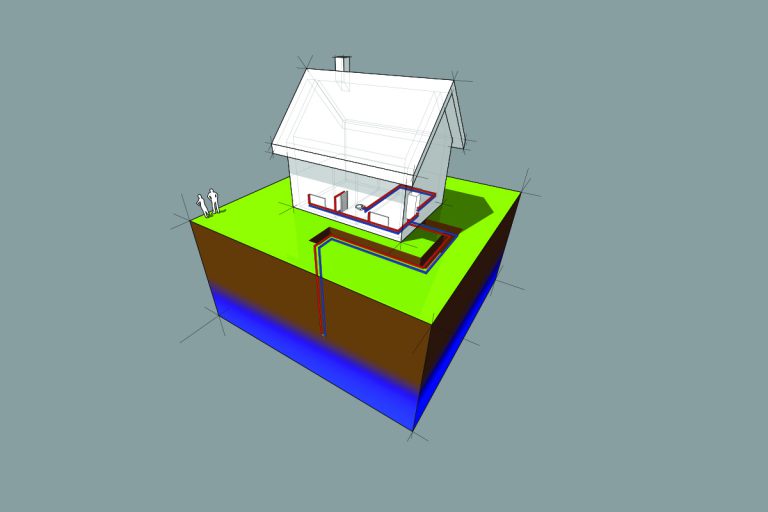

Geothermal Heat Pumps: Helping Save Money – And the Planet

Reliance™ Home Comfort recently introduced geothermal heat pump installation and service in three key regions – including South Western Ontario, Grand River and...

How Reliance Helps Retailers Conserve Capital, Reduce Downtime & Navigate Uncertainty

RelianceTM Commercial Solutions helps Canadian retailers and other commercial businesses minimize downtime, provide useful capital, mitigate unplanned expenses and create an optimal customer...

3 Ways Reliance Helps Beauty Salons Conserve Capital & Prepare for Future Uncertainties

RelianceTM Commercial Solutions helps Canadian beauty salons and other commercial businesses minimize downtime, free up capital for more critically needed investments or injections...

How the Reliance Rental Program Helps Retirement Homes & Other Family Support Centres

RelianceTM Commercial Solutions helps Canadian retirement homes and other family resource and support centres minimize downtime, free up capital for more critically needed...

How the Right Essential Equipment Partner Helps Property Managers Navigate New Challenges

The RelianceTM Property Management program is designed to provide property managers and landlords with best-in-class installation and equipment solutions for their properties in...